by Brian Bosire, Hamza Rkha Chaham and Pierre Ricau

Myself and 2 other young entrepreneurs working in the digitalisation for agriculture sector have learned the hard way that delivering technology-driven solutions for smallholder farmers in Africa can present special challenges. Here, we share some of our insights, including a survival strategy that we think is critical to success – diversify or die.

In developed countries, markets are generally well researched and documented, so start-ups will have accurate data on which to build its market strategy, without having to spend too much time on testing and analysis. That is far from the case in Africa. Here, start-ups have to do their own market research. This adds to the costs, and makes it difficult to develop a single value proposition and business model from the outset.

Dealing with potential investors is often a challenge as a result, since these expect to be presented with detailed business plans that focus on a single product or service. Our experience suggests that this does not work well for start-ups in Africa, and that diversification is a good way to gain efficiency and explore new segments.

Creating derivative products based on the same core technology, and which contribute to the company value proposition, makes it possible to increase business efficiency while exploring connected market pools. For example, if you are using remote sensing technologies to advise wheat farmers on fertiliser use, why not use the same technologies to help fertiliser companies assess the impact of the fertiliser they sell?

While this multi-sided business model may allow African start-ups to survive and even develop, it carries with ít certain marketing and communication risks, which digital entrepreneurs would do well not to ignore. Using experience from running our own digital start-ups, we offer some advice on branching out – highlighting some of the potential pitfalls along the way:

Diversification is key for African digital start-ups…

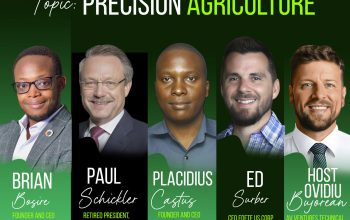

- By developing individual value propositions focused on two different types of customer – farmers and enterprises – Brian Bosire, founder of UjuziKilimo, a start-up developing soil sensors in Kenya, has leveraged soil analysis data acquired from farmers to generate market insights for input enterprises operating in the agricultural sector. He quickly learned that although farmers could not always pay for the soil analysis information his company supplied, they provide valuable feedback that input companies are ready to pay for.

- For Hamza Rkha Chaham, co-founder of SOWIT – a start-up developing remote sensing decision support tools for farmers – diversification is not just a way to reconcile short and long-term financial and strategic objectives. It also drives market exploration. In Morocco, cereals are cultivated on 5 million hectares, with fertiliser accounting for one-third of production costs – representing substantial scope for precision agriculture. However, seeing the need to first gauge the business potential of decision support mechanisms for fertiliser application, he made a strategic move to diversify. So while developing a drone-based decision support tool targeting wheat producers, he started selling SOWIT’s drone technology to other market segments – surveying, mining and construction – and offering drone training packages to ensure short-term income.

- N’kalô is a successful market advisory company operating in Burkina Faso, Côte d’Ivoire, Mali and Senegal, but founder Pierre Ricau soon saw that farmer subscriptions of €0.18 per month would not be enough to secure financial sustainability. Realising that N’kalô would need to find other sources of revenue, he chose to diversify. The current strategy includes selling the company’s market expertise through consultancy projects, and Ricau is exploring solutions such as advertising input companies’ products.

In our experience, diversification has mitigated the income risk, increased returns on investment by maximising assets, and allowed us to explore new market segments. However, it also brought with it a number of challenges.

…but it can also muddy the waters

Diversification is not only confusing for investors, who tend to interpret it as an inability to address a core market. It may also confuse the customers. Addressing different market segments presents a communication challenge. As a start-up with limited resources, it is not always wise to spread a marketing budget over several segments, since it is already hard enough to drive awareness for just one.

Most investors we met preferred to put their capital into simple business models, for which they could establish a clear correspondence with equivalent models in more advanced economies. In addition, many tended to back the trending technologies, rather than the solutions. Even donors and institutions wanted to hear more about artificial intelligence, drones or blockchain than about providing farmers with a way to reduce their fertiliser costs.

For us, technology is a means to deliver what the farmer expects in the most scalable way, and to solve their most pressing challenges linked to inefficiencies. We address investors’ concerns by establishing strong management, mitigating the unintended confusion that could result from diversification. We do this by making that any product we develop still leverages our core technology or know-how, and directly contributes to our main value proposition. Then, when communicating with a specific market, we translate our main value proposition into an individually-adapted one, to ensure we are speaking the market language and avoiding confusion. Finally, we set up time and budget management processes to allocate company resources to the different market segments, and avoid ambiguity.

As entrepreneurs, implementing a strong discipline of resource allocation is crucial. Likewise, developing communication and management skills is essential, not only to prove the benefits of ‘controlled’ diversification to investors, but also to preserve the value proposition of the company over time.

This article was created through a CTA-led process to document and share actionable knowledge on ‘what works’ for ACP agriculture. It capitalises on the insights, lessons and experiences of practitioners to inform and guide the implementation of agriculture for development projects. The article was first published on CTA Blog here.